Effective accounts receivable management is essential for sustaining strong revenue streams and attaining long-term financial stability in the rapid corporate environment of today. Businesses may guarantee that they are paid on time and precisely by streamlining the accounts receivable process, which lowers the amount of capital held in outstanding invoices. The main processes in the accounts receivable process are examined in this blog article, along with the importance of credit policies, best practices for accounting and collections, and techniques and resources for improving automation and lowering the aging of receivables.

Key Steps in the Accounts Receivable Process

Any company that gives its clients credit needs to have a sound accounts receivable procedure in place. Usually, the method entails the following crucial steps:

Credit Approval:

It’s critical to assess a customer’s creditworthiness before granting credit. Monitoring their credit scores, payment histories, and financial situation is all necessary for this.

Invoicing:

It’s critical to provide accurate and timely invoices as soon as the services or products are provided. To prevent misunderstandings, invoices should explicitly include the conditions of payment, deadlines, and the total amount owed.

Processing of Payments:

Accurate processing and recording of incoming payments is necessary. This method guarantees that the ledgers for accounts receivable are current and accurately represent the receivables.

Follow-up and Communication:

It’s crucial to keep in regular contact with clients regarding unpaid payments. Receivables are monitored for timely payment by automated reminders, calls, or even emails.

Reconciliation and Reporting:

It’s critical to consistently match the general sheet with the accounts receivable ledger. Metric reporting, such as Days Sales Outstanding (DSO), can be used to monitor. Also, enhance the efficiency of the receivables management procedure.

Role of Credit Policies in Managing Accounts Receivable

Effective management of accounts receivable is contingent upon the implementation of credit policies. They provide the parameters for who gets funding, how much credit is given, and how it must be repaid. Robust credit policies reduce risk, prevent bad debt, and guarantee uniformity in managing accounts receivable. Based on their financial health and the state of the market, businesses should assess and change their credit rules regularly.

Best Practices for Invoicing and Collections

Effective invoicing and diligent collections are vital to smooth accounts receivable processes. Best practices include:

1. Automating Invoices

Integrating an automated invoicing system is essential to robust accounts receivable procedures. Using accounts receivable software, businesses may automate the preparation additionally distribution of invoices immediately as goods are delivered or services are finished. Its immediate issue ensures that the payment cycle begins without unnecessary delay and contributes to improved cash flow. Automation lessens operator error, which can lead to mistakes that complicate relationships with customers and postpone payments. Electronic invoice presentation and payment (EIPP) is another feature that computerized systems can include. This feature lets clients view and pay their invoices online, speeding up the payment process.

2. Unambiguous Payment Conditions

Another essential component of efficient receivable management is clear payment conditions. From the outset of their client relationships, firms must clearly and unequivocally establish and express their payment conditions. These conditions should specify the permissible payment methods, the payment deadline (e.g., net 30 days), and any late payment penalties. Businesses can avoid misunderstandings and payment disputes. It can cause delays in the receivables process by establishing these expectations early on. In addition to enabling clients to handle their money responsibly. Transparent conditions promote a positive business relationship based on professionalism and respect for one another.

3. Proactive Celebrations

Finally, to guarantee that receivables are paid within the prearranged terms, a proactive approach to collections is essential. This entails carefully handling follow-ups for past-due accounts in addition to promptly mailing invoices. Companies should adopt a methodical approach to collection that may involve calling, emailing, and, if required, escalation protocols for past-due accounts. Maintaining good customer relations requires these discussions to be carried out professionally. Automated reminder systems can also improve this procedure by making sure that no past-due account is overlooked. These systems can send reminders at prearranged intervals, increasing the likelihood that funds will be recovered without the need for ongoing human intervention.

Strategies for Reducing Accounts Receivable Aging

To increase liquidity, accounts receivable aging must be reduced. Among the methods used to do this are:

Providing Early Payment Discounts:

Provide discounts to clients who pay their bills ahead of the due date to encourage timely payments. Cash flow can be greatly accelerated by doing this.

Frequent Account Reviews:

Monitoring customer accounts regularly can aid in the early detection of late payers and the prevention of long-term receivables.

Using Payment Alerts:

By informing clients of impending and past-due payments, automated reminder systems can assist in minimizing the amount of time that invoices remain unpaid.

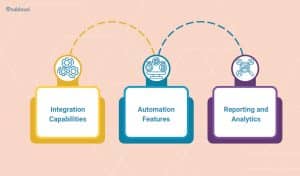

Features of Streamlining the Accounts Receivable Process

Investing in the right tools and software is pivotal for optimizing the accounts receivable process. Such technological solutions not only enhance operational efficiency but also contribute to more accurate and timely financial management. Here’s a deeper look into the essential features that can significantly transform the accounts receivable landscape:

Integration Capabilities

Integrating accounts receivable software with other financial systems, including platforms for enterprise resource planning (ERP), is essential. By facilitating the smooth transfer of financial data between various functional areas, this combination removes the need for manual entry and the mistakes that come with it. For instance, when an ERP system and accounts receivable system are integrated, sales data may be quickly reflected throughout all pertinent departments, inventory levels can be changed throughout, and invoice information can be promptly updated in the general ledger. By guaranteeing that each team has access to the most recent data, this comprehensive integration promotes operational coherence and informed decision-making. Additionally, it improves financial reporting accuracy, which is essential for external compliance along with internal management.

Automation Features

Automation is at the heart of modern accounts receivable systems. Tools that automate routine tasks can significantly reduce the workload of financial teams and minimize human errors. Key automation features include:

Invoice Creation:

After a sale is made or a service is rendered, automated systems can create an invoice right away. This makes sure that no billing chances are lost and that bills are sent out on time.

Payment Reminders:

The software can notify clients when payments are approaching or past due. These reminders can be set up to be sent regularly and personalized based on the age of the account receivable. This helps to keep lines for interaction open and lower the number of days sales outstanding (DSO).

Procedures for Collections:

Automating the procedure for collections can simplify the actions required to pursue overdue payments. To guarantee that more vulnerable accounts receive more prompt attention, automated collections tools can raise issues based on the severity and length of the payment delay.

Reporting and Analytics

Another essential component of an efficient accounts receivable system is advanced analytical and reporting capabilities. Businesses may track important performance measures like average days till payment, receivable turnover rate, and maturing schedules, which provide detailed insights regarding the receivables process. Financial managers can quickly see problems, spot trends, and evaluate client payment behavior if they have access to comprehensive reports and dashboards. Proactively managing collections and credit policies and supporting strategic decision-making are made easier for firms with this level of analysis. Analytics may also help with cash flow forecasting as well as recognizing the financial impact of receivables management on the overall health of the business.

Conclusion

Through adherence to the previously mentioned best practices and the utilization of innovative software and systems for accounts receivable, organizations can enhance their cash flow. Also, streamline their receivables procedures and reduce the time and expenses. These are associated with managing their assets. Ensuring a financially sound, cash-positive organization is the ultimate goal, regardless of the method employed—strong credit policies, proactive invoicing, and collection tactics, or advanced accounts receivable process automation systems.

Managing the intricacies of accounts payable and receivable demands a strategic approach that is customized to the particular requirements of every company. The methods and resources used by companies for effectively handling their financial operations should also change in step with the way that investments are conducted.